Home office expenses have long been deductible for sole traders who conduct business activities from home.

Over time, employees have been increasingly working from home, whether a day or so a week or full-time. COVID-19 lockdowns made working from home widespread for periods of time and raised questions for employers on how to deal with reimbursing employees for business expenses incurred working from home.

Inland Revenue set out guidance on the tax treatment of reimbursements for these business expenses which also bundle in guidance on employees’ work use of their own phones, devices, and telecommunications usage plans, whether working from home or not. The guidance applies to payments made by employers for the period from 1 October 2021 to 31 March 2023.

Reimbursements for personal telecommunications tools and/or usage plans

Employers can reimburse employees who use their personal telecommunications tools and/or usage plans for work, even where the employee is not required to work from home. The tax exempt amount of the reimbursement is calculated in proportion to how much of the usage is work related.

Refer to the decision tree on telecommunications tools and plans below to see how this works.

It’s not always easy to quantify what degree of usage is for business or for private use or to keep track of whether usage changes over time. The employer may:

• require some evidence of time spent to show the asset is used principally for business

• ask for a signed declaration from an employee that the tools will be used principally for work

It is good practice to review usage periodically, say every two years, to check the level of use remains the same. If an employee has completed a signed declaration that the tools will be principally used for employment purposes, a review is only required if there has been a change in circumstances.

Where the employer provides the phones or devices used by the employee for work, there is no question of reimbursement. The cost of the device and usage plan is deductible for the employer. There may be FBT implications if the employee also uses the device for their own use.

Purchases of furniture, equipment, and telecommunications equipment

An employee may need to acquire personal home office furniture, equipment, or telecommunications equipment to enable them to work effectively from home. Where an employer wishes to reimburse an employee for costs incurred in acquiring home office furniture or equipment, they can use:

• the safe harbour options, for furniture and equipment, and for telecommunications equipment or

• the reimbursement option

Refer to the table on furniture, equipment, or telecommunications equipment purchases to see how this works.

If an employer adopts either or both the safe harbour options, note it is not an amount that refreshes annually or otherwise. It is a once only tax exempt reimbursement.

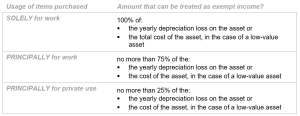

The reimbursement option requires an employer to identify the cost of the asset and determine whether the asset is being used exclusively or principally for employment purposes or principally for private purposes. For assets that are not low-value assets (which are likely to be uncommon), the employer will also need to apply the relevant depreciation rate to calculate the depreciation loss that would have been available to the employee. This increases compliance costs to the employer. The safe harbour option allows for a more streamlined treatment.

Reimbursements for telecommunications tools and usage plans

Reimbursements for furniture, equipment, or telecommunications purchases

Safe harbour options

Note that the limit for each category applies to the costs of ALL the furniture and equipment acquired or ALL the telecommunications equipment acquired. It is not an item by item limit.

Reimbursement option

Even though employees are not entitled to tax deductions for depreciation on assets used for work, Inland Revenue uses depreciation calculations as a guideline for the amount of a reimbursement that can be tax exempt to the employee.

A reimbursement will be tax exempt if:

•the employee purchased the furniture, equipment, or telecommunications tools to enable them to work from home, AND

•the amount is no more than the deduction entitlement calculated for depreciation would be (if employees were entitled to deductions for depreciation)

Our Recommendation

Reimbursements made to employees for equipment required for them to do their jobs effectively are tax deductible to you as the employer. If you are calculating reimbursements on the basis of a proportion of work use, make sure you document how you arrived at that and reviews of the proportion of work use over time.

If you provide equipment to be used for work that your employees also use privately, be aware of the FBT implications.

We can advise you on your options and the documentation required.

BACK TO BLOGS